FinTech or Monetary generation has turn into a well-liked business for serving to to innovate monetary transaction products and services and on-line safety. This is a large time period that works across the industry transformation to innovate the normal monetary products and services which are inefficient, antiquated, and dear. Innovation has made the method clear and easy.

We should know how FinTech Utility Building will definitely develop into the monetary business.

The Emergence of FinTech Utility Building

FinTech generation has reworked and innovated monetary products and services via the brand new applied sciences that experience fulfilled the buyer’s wishes with the assistance of automation. That is because of the standards together with consolidation within the monetary products and services business and regulatory constraints.

It’s all about innovation that has helped so much in upgrading the monetary business. The FinTech startups have the advantage of running independently, and that’s why they are able to expand quicker than the firms following the normal strategies of offering monetary products and services.

To procure the shoppers, the monetary products and services companies have to make a choice from the development in their functions and searching out for a FinTech spouse to get assist in innovation tasks. Monetary products and services have helped the FinTech companies to supply new programs, each at once and not directly. On this case, lots of the companies are going for a hybrid method.

A non-profit innovation heart, FinTech Sandbox used to be established by means of Jean Donnelley in March 2015. The venture at the back of this corporate used to be to convey the most recent applied sciences available in the market and develop into the that means of economic products and services.

As of late, it has helped so much within the building of goods and repair answers that experience the prospective to innovate their monetary products and services.

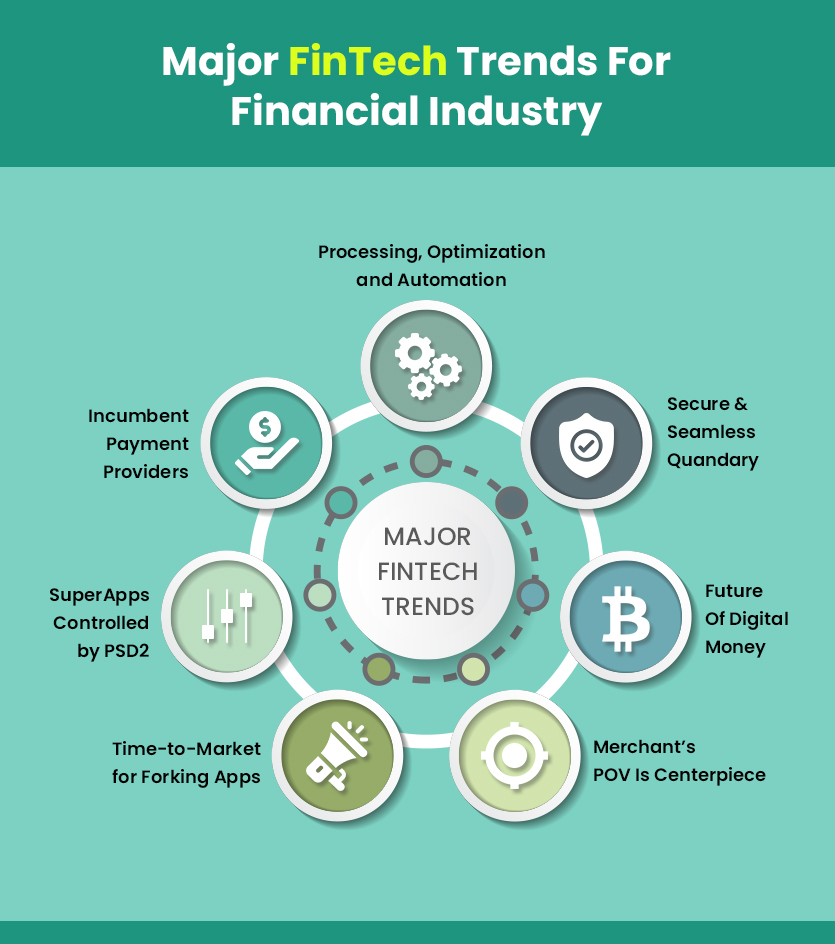

7 Fintech Traits That Will Lend a hand in Upgrading the Monetary Business within the Upcoming Few Years

1. Main Transformation in Banking and Incumbent Cost Suppliers

There was a limiteless analysis within the on-line cost, and the rationale at the back of it’s the emergence of FinTech Development. It’s making an important have an effect on at the monetary business. Within the present state of affairs, the web cost suppliers and backs are converting their running gadget dynamically.

Even because of digitalization or electronic transformation, a lot world industry style has reworked the monetary firms and can do the similar sooner or later. The limits between disconnected business sectors also are disappearing because of the noticeable FinTech development. It has unfolded the doorways for incumbents and FinTech firms. The brand new marketplace gamers available in the market are stealing the shoppers of the outdated marketplace as they paintings at the innovation. This present day, folks focal point on monetary products and services because it has made the entirety more straightforward for them.

The worldwide Fintech adoption price is forecasted to succeed in 52%, and additionally it is proved that by means of 2025, lots of the international inhabitants will use FinTech products and services. It’s as a result of Subsequent-generation cost strategies that bypass banks and bank card industries are adopting. That’s why it’s mentioned that FinTech firms will have to goal to provide leading edge products and services to standard banks.

2. SuperApps Are Managed by means of PSD2 and Open Banking

Banking isn’t just about monetary products and services; it’s about synthetic intelligence, mechanical device finding out, the most recent electronic applied sciences, and the facility to leverage the ability of purchaser insights. It is helping the shoppers to get right kind amenities on this tech-savvy international. However how the banking gadget can affect the most recent rules like PSD2? By means of offering the visitor’s database to third-party carrier suppliers in a secure manner.

The organizations from other industries like banking, media, and different tech-oriented firms compete for this knowledge. Alternatively, the buyer’s information for protected bills are lifted by means of FinTech Firms. Their function has been well-established within the Marketplace. Once we speak about Tremendous Apps, those don’t seem to be one thing new. There are lots of peer-to-peer lending and making an investment platforms which are offering monetary products and services to other companies via the most recent applied sciences.

All of them have some refined platforms, however they provide their consumers the products and services via aggregated tremendous apps. It is helping their consumers to get upper returns on their investments. Even though there aren’t any hidden charges in those strategies. The use of no hidden charges is how the FinTech firms have received the marketplace proportion and earn aggressive benefits over regular banking strategies.

three. The Virtual Transformation in Fintech Has Helped in Enabling Time-To-Marketplace for Forking Packages

There was super enlargement within the Cashless/Cell Cost. Each Banks and PSPs are in search of the chance to unencumber the most productive product-market in order that they are able to are compatible within the FinTech programs. Ever the previous gamers, who had been a part of the FinTech Virtual Transformation Methods, are actually ready to transport forward. They may be able to dive into new monetary answers.

The brand new programs for Instrument construct have made all of the processes, together with tool infrastructure, checking out, building procedure, supply code, elasticity, and self-healing simple. Many of the Fintech resolution suppliers focal point on streamlining tool engineer’s paintings. As a result of the API’s and Instrument libraries, the Instrument mavens can serve their purchasers with the most productive person revel in.

This has helped the business to supply usual products and services, out-of-the-box automation, framework, safety functions, and tracking. Even with a large number of amenities, one can’t be capable to fortify their industry with out natural generation pillars. It is helping the customers to scale back the fraud dangers.

four. Service provider’s POV Is a Centerpiece and the Long term of Cost Answers

As everybody has the reachability to the next-gen FinTech Answers, they are able to use the web cost answers every time they wish to. It helped the traders to regulate their gross sales issues and settle for the bills during the web or cell units. Even there are numerous techniques to obtain the cost that may be excessed by means of everybody. As a result of this reason why, maximum FinTech firms can procedure huge cash in on-line transactions each and every yr.

When folks use to discuss with the shop and pay from money, they generally tend to turn into certain. However as of late, everybody will get a possibility to pay from anyplace. This is a likelihood to construct a greater courting between consumers, traders, and cost intermediaries. It’s simply; all of the traders will have to perceive the benefits of the next-gen level of the sale and observe it of their products and services.

Once we speak about card enlargement, it has turn into a approach to bridge the distance of common acceptance. Even whilst settling on the web PSP, the traders make a choice safety as their precedence. They’re additionally specializing in Automation as it is going to make their paintings simple. And the most productive phase is that buyers are already conscious about the in-app bills. In-app bills permit them to buy anything else and get it delivered at their doorstep. Having your personal tastes delivered to the doorstep proves that everybody will get a possibility of personalization.

five. The Long term of Virtual Cash

It’s been years since we will be able to see the noticeable enlargement within the electronic financial system, the place cell units have enabled an explosion in non-traditional monetary products and services. Non-traditional products and services is the place FinTech firms can thrive. New on-line cost strategies are creating a courting between folks and generation.

Alternatively, Making FinTec apps secure and protected will have to be the concern of main tech firms. It may possibly end up fruitful for them ultimately. The web of items has taken off at an overly speedy tempo. As there are lots of the machine-to-machine transactions, the general public name it a digital-only international.

The Bodily cash idea is diminishing by means of time. Now, lots of the transactions are invisible, i.e., finished during the web. There is not any want to withdraw your cash and pay it to the traders. Virtual-money has turn into an crucial a part of our lifestyles. The most productive phase is that lots of the on-line programs are giving a possibility to the shoppers to e book a desk at eating places, flight, film tickets, and resort rooms or purchase different stuff on-line.

There is not any involvement of genuine cash, which proves that bodily cash change is getting changed with the cell wallets.

6. Protected and Seamless Dilemma

The extent of fraudsters continues to conform. Even though there are such a large amount of fraud prevention equipment provide available in the market, it’s nonetheless getting sophisticated and dear to offer protection to consumers and traders from it. The primary reason why at the back of it’s the loss of seamless integration between the traders and card problems.

Even the chargeback processes get damaged every now and then as a result of they’re by no means designed to proportion actionable intelligence. That’s the explanation why it’s arduous to keep away from the losses of the cardboard issuers and traders. Many of the Cardholders and Traders’ lawsuits are that the present chargeback procedure is slightly complicated, irritating, and dear.

It’s now not near to charge; the direct expense has the chargebacks. Chargebacks decelerate gross sales and building up visitor resistance, and lots of doable consumers gets grew to become away as a result of the top charge of fraud improving.

Each Fraud and Chargebacks are expensive and will injury the popularity of a industry. Alternatively, there are such a large amount of safety applied sciences and fingerprint popularity choices which were offered available in the market. The primary reason why for those choices is to scale back fraud and chargebacks.

They’ve assured authentic card cost choices with different amenities. And it’s a lot more straightforward than the money bills. Additionally, it is helping in putting off the friction between the traders and consumers. On this innovation, mechanical device finding out and complicated information analytics play an important function. It is helping in figuring out the patron and service provider at the back of each and every transaction and scale back the danger of fraud.

7. Processing, Optimization, and Automation

A couple of years in the past, it used to be arduous to consider the rising price of economic products and services firms. At the moment, consumers use to contain only one or two organizations. However now, FinTech firms are ruling the business. They give you the highest products and services of the backs to their consumers and is helping available in the market enlargement. For this reason why lots of the consumers take care of a number of monetary carrier suppliers.

If we speak about FinTech enlargement, it came about after the 2008 monetary disaster. At the moment, lots of the banks pulled again on virtually each and every task to scale back the danger price. This allowed the FinTech firms to contain with the again and construct a complete new marketplace position. Now, we are living within the digitally reworked international, the place the financial system has modified its route and backs are specializing in filling the distance to rouse their misplaced.

As the entire marketplace is customer-oriented, the banks and traders have to concentrate on development a greater courting with them. They’ve to scale back the fee and save their time to enhance their industry. The banks and FinTech Firms and banks are specializing in those issues, and that’s why they’ve offered the robot procedure automation. It is among the impactful developments of FinTech. It’s rapid, cost-saving, scalable, built-in, and gives top quality products and services. This has modified the entire running gadget.

What Can You Be informed from Fintech Firms?

Conventional banks can undertake FinTech Practices in 3 ways. It’ll assist them to tell apart their logo and lead from their competition on this abruptly upgrading industry setting.

1. Transfer Past Your Convenience Zone.

For the expansion, the firms have to come back out in their convenience zone. FinTech Firms has proved that measurement is now not coverage from a savvy startup. Where the place the generation is influencing the buyer’s wishes is the realm the place you get unending alternatives. Right here, the possibilities to are expecting the long run is far much less.

Conventional banks need to apply the innovation and entrepreneurial strategies of FinTechs into their industry; in a different way, they’ll fall at the back of.

2. Practice a Buyer-Centric Method.

Probably the most greatest differentiators between FinTechs and conventional banks is that FinTech firms paintings at the customer-first method. It is helping them to care for the entirety digitally and design and ship the goods accordingly. All digital-savvy consumers are in search of comfort, ease, and comprehensible on-line banking.

To give you the consumers with the similar, an organization will have to know what their consumers need. Device-based finding out and different applied sciences have helped in gaining insights.

three. Leverage Your Knowledge.

FinTech Firms had been the startups that experience the rate and nimbleness to guide the innovation the place regular banks are nonetheless suffering. However lots of the banks be offering a fair proportion of benefits in relation to information. Many of the well-established firms can retailer huge information with time. They will have to use the similar information to know their visitor’s necessities.

Alternatively, lots of the advanced logo is following machine-based finding out and AI to assist their consumers to satisfy their wishes. Additionally, they’re offering extra time for his or her workers to concentrate on advanced answers.

Conclusion

FinTech will develop into the Monetary Business by means of running at the following ideas: the real-time cost strategies, synthetic intelligence, business four.zero, newest applied sciences, extra in-depth and higher information seize, Blockchain, Participating into one and Robo-advisors. That is how the normal financial institution business will ready to transport nearer to innovation.

Now, you know the way the FinTech Utility building will develop into the monetary business in upcoming years. You understand how they’ll reshape the monetary business and lots of different similar spaces.

So if you wish to construct your disruptive electronic technique, focal point at the following:

- Center of attention on Cybersecurity.

- Perceive some great benefits of mechanical device finding out and synthetic intelligence and observe them to what you are promoting.

- Use Robot procedure automation to control the buyer’s database in a quick and systematic way.

- Be Consumer-oriented and be offering higher products and services.

- Take the advantage of the electronic transformation.

- Remember to satisfy the present calls for.

The FinTech has the prospective to develop into the industry’s nature with applied sciences and following developments, together with development a greater courting between traders and consumers, and anything else that may clear up the issue of economic inclusion.